Greek Antiquities Among 3,500 Illegally Obtained Objects Confiscated.

International authorities confiscated over 3,500 illegally obtained antiquities across Europe, including four objects of historical value in Greece.

Under operation “Pandora” that took place across Europe and investigates the illicit trade in antiquities, over 3,500 have been confiscated. The operation was carried out by police authorities from 18 European Union member states, UNESCO, the World Customs Organization, Europol and Interpol.

Operation Pandora began in October and ended in December. Its aim was to crack down on trafficking in Europe of antiquities from the Syria and Iraq war zones. The division of Greek police involved in illicit trade in antiquities participated in the operation. According to Europol data, 3,561 ancient objects were confiscated and 75 people were arrested. A total of 29,340 vehicles and 50 ships were searched. Over 500 objects were found in Murcia, Spain, stolen from the city museum.

In Greece, authorities found an Ottoman tombstone, a Byzantine icon of Saint George and two more Byzantine objects of great historical value. The antiquities were found in the possession of a Thessaloniki businessman.

Lear More

MASCRADE 2017 Movement Against Smuggling & Counterfeit Trade, New Delhi

Illicit Trade: A Growing Economic Menace

12/10/2017 | ITC Maurya, New Delhi, India

Illicit trade holistically disrupts the sustainable development of a nation. It not only leads to loss of revenues to states, but also risks legitimate businesses. Besides, illicit trade causes significant threats to the health, safety and security of the citizens, as well as adds to costs on governance, environment and biodiversity. Moreover, globally it fuels transnational crime, corruption, and terrorism. As it converges with other criminal activities, it undermines the rule of law and the legitimate market economy, creating greater insecurity and instability around the world.

Across the globe, illicit networks are infiltrating and corrupting the economic development of the nations. With the advent of technology, illicit trade and organized crime have found voguish nexus causing the problem to increase manifold. FICCI’s Committee Against Smuggling and Counterfeiting Activities Destroying the Economy [CASCADE] has, over the years, been concertedly addressing this issue through its various pan-India awareness generation activities, building capacities of law enforcement officials and undertaking ground breaking research on the extent and impact of the menace.

In furtherance of its mandate, FICCI CASCADE organized the 4th edition of its International Conference titled – MASCRADE, 2017- Movement Against Smuggling and Counterfeit Trade in New Delhi on 12th and 13th October 2017. The theme of this year’s conference was Protect Your Brand Globally: Fight Counterfeiting, Smuggling and Piracy. MASCRADE 2017 was structured to ensure that national and international stakeholders deliberated to identify opportunities for joint action between governments, private sector, and enforcement machinery to combat illegal trade. The objective was to:

- Look at the economic consequences of mass counterfeiting, smuggling & piracy and the strategies needed to deter this activity

- Contribute to an integrated vision of security and public safety

- Deepen understanding of “grey markets” for illicit goods, to assess their impact, and to promote practical recommendations and effective strategies by the public and private sectors to dismantle them

- Develop a better enforcement ecosystem and to protect the interest of brand owners in India

Inaugurating the conference, Mr. Shatrughan Sinha, Member of Parliament, Lok Sabha, emphasized on the need to focus on not only to promote India’s goods and services, but also to increasingly protect our goods and services against smuggling and counterfeiting. He urged all the stakeholders to take this agenda to the global platform and engage actively with transnational enforcement agencies, including NRIs, in the movement against illicit trade. Lauding FICCI CASCADE’s commitment and drive to curb smuggling and all forms of illicit trade, which was helping in creating awareness on this serious problem, he observed that more such initiatives were called for to change the mind set of consumers on the use of illicit goods and services, and the role they could play in the fight against the growing socio-economic threat.

Mr. Suresh Prabhakar Prabhu, Union Minister for Commerce and Industry, Government of India, through a video message, underlined the fact that with India moving towards becoming a knowledge economy, respecting and protecting the knowledge and intellectual property of its creators was a key component for the country’s rapid growth. He assured the forum that the government was committed to this end, and was taking measures to put in place a robust and effective regime to guard the economy against all forms of illicit trade.

Mr. Anil Rajput, Chairman, FICCI CASCADE, in his welcome address, stated “Proceeds from Illicit trade are increasingly becoming the main source of terror funding. We need to understand this relationship and work towards effective mechanisms to counter its worldwide impact. It is a race against time as all of us are the stakeholders. The policymakers are steadily taking steps but the need of the hour is to seek bold and out of the box solutions”.

Highlighting the several initiatives undertaken by the Government of India to fight the menace of smuggling and counterfeiting, Mr. Pranab Kumar Das, Member, Customs, Central Board of Excise and Customs, highlighted the need to create ownership and to build a relationship of trust between the government agencies and private sector. The need of the hour was to create a level-playing field for the stakeholders to curb tax evasion, black economy and revenue losses, he observed, while adding that CBEC was a potent force which was ready to partner with FICCI and the private sector to fight illicit trade.

Mr. Sergey Kapinos, Regional Representative, South Asia, United Nations Office of Drugs and Crime (UNODC), in his address, said that smuggling and counterfeiting goods not only hampered the economic growth of a country but also adversely affected the social fabric and the well-being of its people. There was a growing need to collaborate globally for framing robust policies and effective implementation to curtail this economic menace, he added.

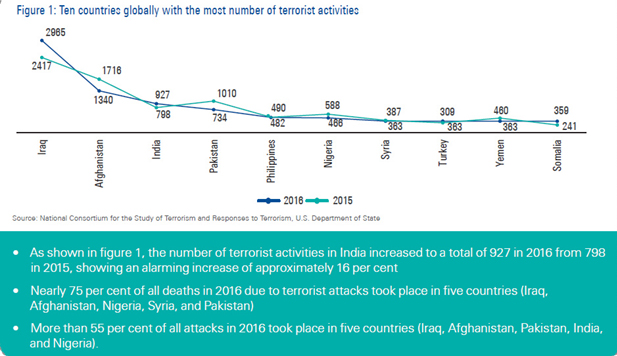

During the conference, FICCI CASCADE and KPMG India released a report titled- ‘Illicit trade: Fuelling Terror Financing and Organised Crime’. According to the report, India was the third most affected country by terrorist activities in 2016, with the first and second positions occupied by Iraq and Afghanistan, respectively. Another feature highlighted is that counterfeiting stands as the second largest source of income for criminal activities such as terrorism globally, as estimated by United Nations Commission on Crime Prevention and Criminal Justice (UNCCPCJ). Also, terrorist organisations are manufacturing counterfeit goods and smuggling them across borders to finance their crime operations. Prominent terrorist organizations such as Hezbollah, Lashkar-e-Taiba, Al Qaida, Irish Republican Army, etc. rely on illicit trade for financing up to 20% of terror operations.

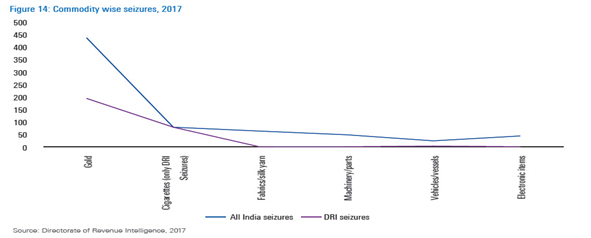

The report also highlights that the total employment losses globally due to counterfeits and piracy stood at 2 to 2.6 million jobs in 2013 and is expected to rise to 4.2 to 5.4 million jobs in 2022, suggesting an approximate increase of 110 per cent. The most commonly counterfeited and smuggled goods are tobacco, cigarettes, electronic items, gold, machinery and parts, alcoholic beverages, auto components, Fast Moving Consumer Goods (FMCG) and mobile phones. As per KPMG, in India’s analysis on UN COMTRADE data for years 2012-16, the average annual smuggling of electronics was around Rs. 3,430 crore. Similarly, the average smuggling of gold for these years was Rs. 3,120 crore, and machinery and parts Rs. 5,913 crore. Further, the percentage penetration of illicit trade in the cigarettes market increased from 15% to 21%. Factors like higher taxation rates, availability of cheaper alternatives, lack of awareness and lack of enforcement mechanisms are key factors that drive illegal trade in India.

The conference, spread over two days, highlighted and deliberated on issues such as ways of countering illicit market operations, defending brands, reputational and financial impact due to illicit market operations, collaborations among law enforcement agencies to fight illicit trade and cross border organized crime, combating content theft in the digital economy, anti-counterfeiting, anti-smuggling & brand protection strategies and solutions – among others. The discussions also focused on the socio-economic consequences of cross border illicit trade and the policies needed to deter this activity. The interactions contributed to an integrated vision of national security and public safety, enabling an interdisciplinary dialogue among the participating industry regulators, customs and law enforcement officials, major producers of consumer goods, consumer associations and NGOs. With an underlying objective to deepen understanding of illicit trading activities across borders, the meet also was a useful forum to discuss effective strategies to dismantle such illegal business practices by the public and private sectors.

The conference saw participation of a host of notable international speakers from World Customs Organization (WCO), INTERPOL, United Nations Office for Drugs and Crime (UNODC), Organization for Economic Corporation and Development (OECD), US Homeland Security and US Patents and Trademarks Office, and senior private sector executives from Louis Vuitton, Beiersdorf, PUMA, etc. The forum was also addressed by senior Indian government officials, including Mr. Rajiv Aggarwal, Joint Secretary, Department of Industrial Policy & Promotion, Ministry of Commerce and Industry; Mr. D. P Dash, Director General, Directorate of Revenue Intelligence; Mr. Sushil Satpute, Director, DIPP; Mr. M M Oberoi, Joint Commissioner, Delhi Police.

India has a committed border protection force as well as enforcement agencies that not only safeguard the long national borders against trans-border criminals, including smugglers and terrorists, but also enforce anti-smuggling & anti-counterfeiting laws. To encourage and acknowledge the work of India’s law enforcement agencies, FICCI CASCADE, during the MASCRADE 2017, also felicitated the best performing officers for the period 2016-17 for their outstanding achievement in the preventing of illicit trade, and enforcing of anti-smuggling & anti-counterfeiting laws from several Government agencies such as:

1. Indian Customs

2. Directorate of Revenue Intelligence

3. Indian Coast Guard

4. Sashastra Seema Bal

5. Assam Rifles

6. Delhi Police

Media CoverageDownload Pdf

Post Conference Report.Download Pdf

‘India suffering significant economic consequences due to smuggling’.

India is suffering significant economic, health and safety consequences as a result of widespread smuggling and counterfeiting in the country, said a senior government official on Tuesday.

“Illicit trade is a global problem of enormous scale, impacting human lives and virtually every industry sector around the world — and India is no exception. It is suffering significant economic and health and safety consequences as a result of widespread smuggling and counterfeiting in the country,” said Reena Arya, Additional Director General of the National Academy of Customs, Indirect Tax and Narcotics (NACIN).

Arya was speaking at a capacity building programme organised by NACIN and FICCI’s Committee Against Smuggling and Counterfeiting Activities (CASCADE).

As per FICCI’s CASCADE report, the total loss to thegovernment on account of illicit markets in just seven manufacturing sectors is Rs 39,239 crore in 2014.

Lear More

Socio–economic Impact of Illicit Trade, Faridabad

26/9/2017 | Faridabad

FICCI CASCADE in association with the National Academy of Customs, Indirect Tax and Narcotics, (NACIN) organized a capacity building programme on the ‘Socio-Economic Impact of Illicit Trade’ on September 26, 2017 in Faridabad. The objective was to sensitize officers of the Indian Revenue Service (Customs, Indirect Tax and Narcotics) on the ill effects of illicit trade, with special focus on the menace of smuggling, on the economy and society as a whole.

Ms. Reena Arya (IRS), Additional Director General, NACIN, in her opening remarks, stated that illicit trade was a global problem of enormous scale, impacting human lives and virtually every industry sector around the world. The speakers deliberated on various aspects and shared their insights on how to handle issues like smuggling and counterfeiting. They also interacted actively with the officers on the ways and means to counter this threat. Some of the key issues discussed were as follows:

- Developing local intelligence is key to address the challenges related to smuggling

- Coordinated and serious enforcement is one of the best ways to counter illegal trade in industry

- Deterrence has to be created for effective enforcement

The capacity building programme was attended by over 120 officers in day-long interactive event.

Lear MoreAlmost two million cigarettes seized in Brisbane after massive Border Force sting

ALMOST Two million illegal cigarettes were seized in Brisbane this week in a massive Australian Border Force sting.

On Sunday, an airfreight consignment was examined by ABF officers after arriving into Brisbane.

There were allegedly 1,975,400 cigarettes in boxes inside, that had been falsely declared as dehumidifiers. A further delivery took place on Wednesday at a storage facility in a South Brisbane suburb, where four adults, three men and one woman, were arrested.

The group faced Cleveland Magistrates Court yesterday, the ABF said. The group was charged with tobacco smuggling offences under the Customs Act 1901. ABF Acting Superintendent Robert Ansell said illicit tobacco can be sold at more than 60 times its offshore price

Lear More

Fake Goods Valued At $65m Seized By Customs In Less Than Two Years

Approximately $65 million worth of infringing products were successfully forfeited and disposed of by the Jamaica Customs Agency (JCA), acting on behalf of brand-holders, for the period January 2016 to September 2017.

Velma Ricketts Walker, the commissioner of Customs, told The Gleaner that backpacks/bags represented approximately $43 million of the total and that the effect of the importation of fake goods could be catastrophic for the country’s fragile economy.

“The threat of international property rights infringement must not be seen as a victimless crime. It can have serious negative effect on the country’s economic growth, impacting of course, the gross domestic product (GDP),” said Ricketts Walker.

“These items, not being the original goods, are cheaper, but could prove disastrous to GDP,” Ricketts Walker added.

She said an additional $500 million worth of goods was seized and is to be disposed of, which points to the tough job Customs has in cracking down on the importation of counterfeit products.

Lear MoreCigarettes, gold most smuggled items in Gujarat

Ahmedabad: Estimates by officials of Directorate of Revenue Intelligence (DRI) – Ahmedabad Zonal Unit, indicate that cigarettes and gold are among the highest smuggled commodities in Gujarat. “While some 80 lakh sticks of cigarettes were smuggled in Gujarat from April to July, about 110kg gold was smuggled in the same period. The risk and investment involved in smuggling of cigarette is lesser than what it is for gold,” said Arvind Kumar Chaurasia, deputy director, DRI – Ahmedabad Zonal Unit.

Smuggling of cigarettes yields higher profits than what is earned in gold, said Chaurasia. He was present at a seminar and panel discussion on ‘Combating Counterfeiting and Smuggling – An Imperative to Accelerate Economic Development’, organized in Ahmedabad on Friday.

Disparity in taxes and prices of the same commodities usually leads to increase in smuggling. Among other items being smuggled into Gujarat, include Red Sanders, diamond powder and pharmaceuticals.

Lear More

Customs and Border Police Officers Prevented an Attempt for Smuggling of 1,551 boxes Cigarettes

A joint check by customs and border police officers prevented an attempt for smuggling of 1,551 boxes (31, 020 pieces) of cigarettes, reported the Bulgarian National Television.

On the “Incoming Cars and Buses” lane at Kapitan Andreevo Border crossing, a “Mercedes Benz” minibus with an Iraqi registration arrived from Turkey. It was travelling to England. The passengers were a family with four children. The adult passengers told the customsauthorities that they did not carry goods for declaring.

Lear More

12,000 pairs of fake branded shoes seized

CHENNAI: The next time a local trader in the city offers a 75% or a 90% discount on shoes of foreign brands, he might well be selling fake Chinese goods.

The Special Intelligence and Investigation Branch (SIIB) of Chennai Seaport Customs recently made a big seizure of such counterfeit shoes. In all, 12,000 pairs worth approximately Rs 3.5 crore were confiscated from a container that came from China.

Such consignments have been regularly making their way into Chennai through the sea-port. The importers mis-declare them as ‘unbranded ladies purse’, car hanging accessories and porcelain tiles. The shoes are of popular brands like Adidas, Nike and Reebok.

It is difficult for the customer to ascertain the genuineness of the goods as the manufacturers print a fake unique product code (UPC), similar to the ones the original shoes have.

Lear More

Vietnam seizes Apple gadgets smuggled from US, gold from Thailand

20 kilos of suspected gold was hid on a flight from Bangkok to Hanoi while the Apple package was sent to Saigon via post.

Customs officers in Ho Chi Minh City on Friday said they had just seized the largest postal package of iPhones and iPads smuggled from the U.S. The shipment included 144 smartphones and tablets, most of them new and of the latest versions.

It was labeled as non-commercial package and declared to contain computer mouses and keyboards, the officers said, as cited by local media. The recipient has been identified as a resident in District 1 in the city downtown.

Also on Friday, more than 20 kilograms of what was suspected as gold from a Bangkok flight was seized at Noi Bai Airport in Hanoi.

Lear More