Nobody is immune to negative effect of contraband tobacco

As British Columbia completes its annual pre-budget consultation, the province would be wise to exercise extreme caution when it comes to tobacco taxation. While governments have been known to be quite addicted to tobacco taxes, and use taxation as an easy fix — as evidenced by the latest $2-per-carton increase that took effect in B.C. on Oct. 1 — there are serious negative and unintended consequences that come with a high tax policy. It does not take a degree in economics to figure out what happens when the price of a product is increased time and again: Consumers look for cheaper alternatives. When it comes to tobacco in Canada, that alternative is readily available through an illegal, untaxed and unregulated market. While B.C. is fortunate to have not yet seen illegal tobacco levels like those found in Ontario and Quebec, which reached 48 per cent and 40 per cent respectively in 2008, the threat remains very real. In recent years, illegal tobacco shipments from Ontario and Quebec have been seized across Canada, including in B.C.

Related Posts

Duplicate toys of popular brands seized in Burrabazar

Two US-based companies had apparently found out about the sale of duplicate toys...

Ahmedabad: Absconder caught with Rs 30 lakh in fake currency notes

AHMEDABAD: A 40-year-old man from Mansa of Gandhinagar was caught in the net of...

P5.3 B worth of fake goods – mostly cigarettes – seized in Q1

Most fake or counterfeit goods confiscated by the government in the first quarter...

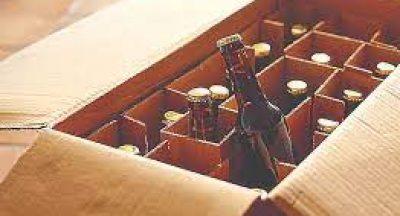

45 crates of fake liquor seized

The local police claimed to have confiscated 45 crates of country-made liquor,...