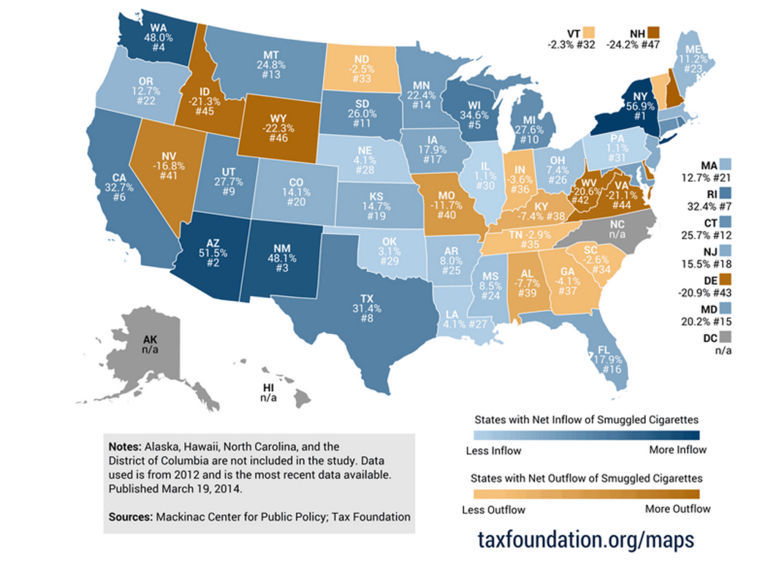

Report: High cigarette tax fuels black market in state

PHOENIX — A cigarette tax higher than neighboring states and cheaper prices on American Indian reservations have helped fuel a growing a black market for cigarettes in Arizona, according a study by a Washington, D.C., think tank. The Tax Foundation, a nonpartisan group that advocates for transparent and broad-based taxation, estimated that smuggled cigarettes made up 51.5 percent of Arizona’s cigarette consumption in 2012. While Arizona taxes cigarettes at $2 per pack, the taxes in neighboring states range from 80 cents per pack in Nevada to $1.66 per pack in New Mexico. American Indian reservations also are less-expensive sources of cigarettes. “All this works in concert to make it a very profitable market,” said Scott Drenkard, economist at the Tax Foundation. Arizona’s estimated percentage of smuggled cigarettes ranked second in the report to 56.9 percent in New York, which had the nation’s the highest tax per pack at $4.35.

Related Posts

Zambia: Hologram Arrival to Boost Piracy Fight

ZAMBIA: The holograms which will be affixed on audio-visual products are...

State nabs 4 people for smuggling 72,000 packs of contraband tobacco products

Authorities have confiscated about 72,000 packs of contraband cigarettes worth...

PIL on fake water bottles, medicines

The petition by Satish Chandra, filed through advocate Abhiuday Chandra, has...

Over P2M alleged smuggled cigarettes seized in NorMin

Authorities confiscated alleged smuggled cigarettes worth around P2.5 million...